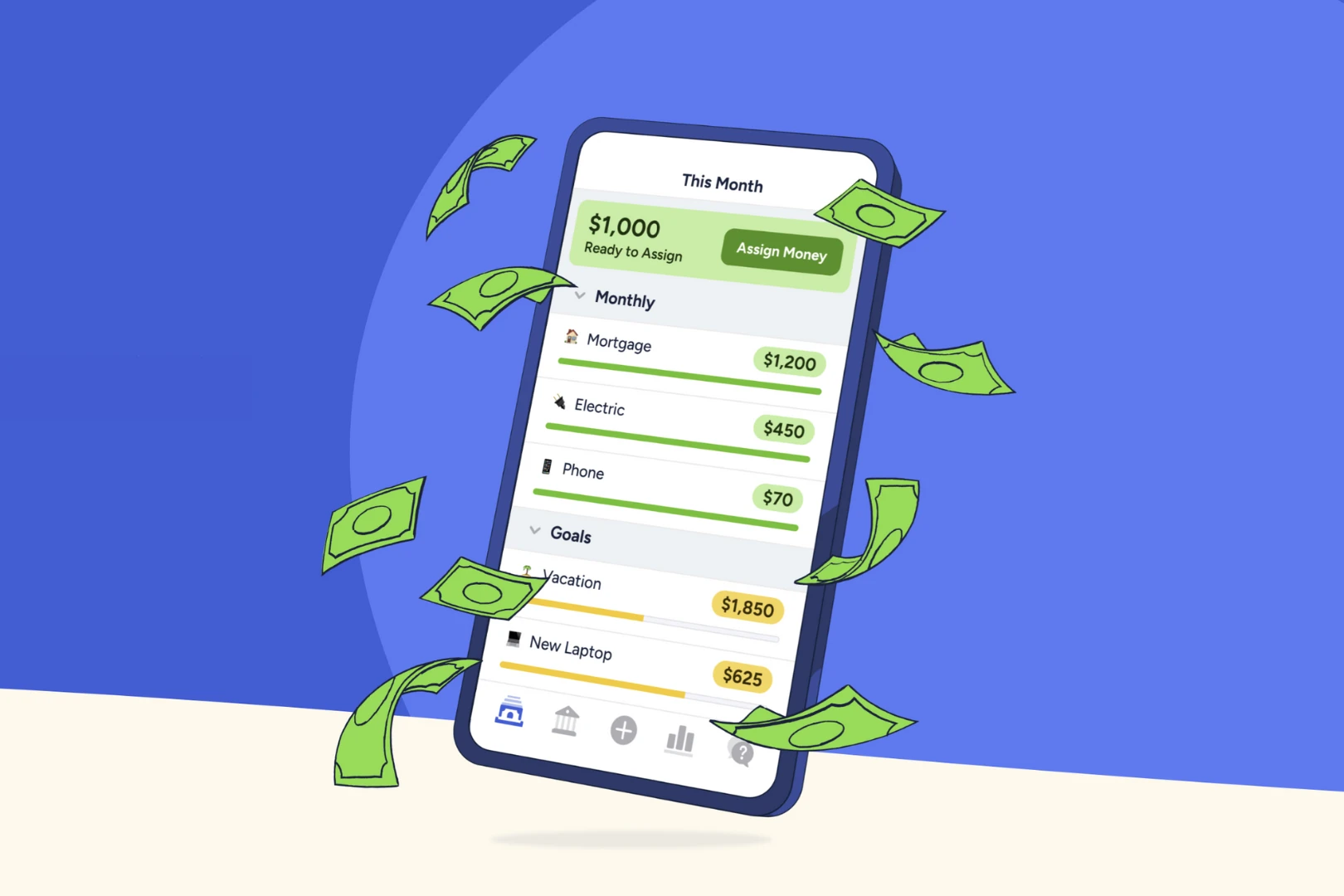

Photo credit: YNAB

Let’s be honest. Budgeting isn’t exactly the most thrilling activity. It invokes images of spreadsheets, calculators, and that sinking feeling when you realize you’ve overspent (again). But what if I told you that managing your money doesn’t have to be a chore? In fact, it can be as easy as tapping a few buttons on your phone, thanks to the magic of budgeting apps.

These handy tools have revolutionized the way we handle our money, putting the power of financial management right in our pockets. No more spreadsheets, no more shoeboxes full of receipts – just a few taps on your smartphone can give you a clear picture of your financial situation. Budgeting apps are your new best friends in the quest for financial freedom.

In this article, we’ll explore the world of budgeting apps, their features and benefits, and how they can make managing money easier and, dare I say, even enjoyable.

What Budgeting Apps Can Do For You

Budgeting apps are more than just digital checkbooks. They’re like having a personal financial advisor in your pocket, minus the hefty fees. Let’s break down some of the key features and benefits they offer:

Tracking Your Spending: One of the most basic (and essential) features of budgeting apps is expense tracking. They automatically categorize your transactions, giving you a clear picture of where your money is going. Are those daily lattes adding up more than you thought? Your app will let you know.

Setting Budgets: Budgeting apps help you create realistic budgets based on your income and expenses. They allow you to allocate funds to different categories (like groceries, rent, and entertainment) and track your progress throughout the month. Some apps even send you alerts when you’re nearing your spending limits.

Saving Goals: Whether you’re saving for a down payment on a house, a dream vacation, or just a rainy day fund, budgeting apps can help you set and achieve your savings goals. They often include features like automated savings plans, progress trackers, and even motivational messages to keep you on track.

Debt Management: If you’re struggling with debt, budgeting apps can be a lifesaver. They help you track your debt balances, set payoff goals, and even calculate the most effective payment strategies.

Investment Opportunities: Many budgeting apps now offer investment features, allowing you to dip your toes into the world of stocks, ETFs, or other investment options. Some even provide educational resources to help you make informed investment decisions.

Beyond the Basics: Some budgeting apps go above and beyond, offering features like bill payment reminders, credit score monitoring, personalized financial advice, and even the ability to connect with financial professionals for additional support.

In short, budgeting apps can simplify your financial life by automating tasks, providing insights into your spending habits, and empowering you to make smarter financial decisions.

Choosing the Right Budgeting App: It’s All About You

The best budgeting app is the one that you’ll actually use. Choose an app that you find helpful, motivating, and enjoyable to use. It should make managing your money feel less like a chore and more like a step toward achieving your financial goals. Here are some factors to consider:

Free vs. Paid: Many budgeting apps offer a free version with basic features, while others require a subscription for premium features like investment tracking or personalized financial advice. Consider your budget and what features are most important to you before making a decision.

User Interface: The app should be intuitive and easy to navigate. Look for an interface that you find visually appealing and user-friendly. After all, you’ll be using it regularly, so you want it to be a pleasant experience.

Features: Make a list of the features that are most important to you. Do you need a simple expense tracker, or are you looking for an app that also offers investment options and financial advice? Once you know what you need, you can narrow down your choices.

Security: Your financial data is sensitive, so make sure the app you choose has robust security measures in place. Look for features like two-factor authentication, data encryption, and strong privacy policies.

Compatibility: Ensure that the app is compatible with your devices and operating systems. Some apps are available for both iOS and Android, while others may be exclusive to one platform.

Reviews and Ratings: Check out online reviews and ratings from other users to get an idea of the app’s pros and cons. Look for feedback on user experience, customer support, and overall effectiveness.

Try Before You Buy: Many budgeting apps offer free trials, allowing you to test them out before committing to a subscription. Take advantage of these trials to see how the app works and if it’s a good fit for you.

The Different Flavors of Budgeting Apps: Finding Your Perfect Fit

Budgeting apps are like different flavors of ice cream, each serving different tastes and needs. No matter if you’re just starting or a budgeting expert, there’s an app out there designed with you in mind.

- Manual Entry Apps: These apps require you to manually input your income and expenses. While this may seem a bit tedious, it can be a great way to stay mindful of your spending habits.

- Automatic Tracking Apps: These apps connect to your bank accounts and credit cards, automatically tracking your transactions. This can save you time and effort, but it’s important to review the data regularly to ensure accuracy.

- Envelope Budgeting Apps: Based on the traditional “envelope” method, these apps help you allocate specific amounts to different spending categories, like groceries, entertainment, or transportation.

- Zero-Based Budgeting Apps: These apps encourage you to give every dollar a job, meaning your income minus your expenses should equal zero. This approach can be very effective for those who want to take full control of their finances.

- All-In-One Apps: These apps combine budgeting features with other financial tools, like investment tracking, debt management, or credit score monitoring. They’re a great option for those who want a comprehensive financial management solution.

Key Features to Look For

- Expense Tracking: The ability to track your spending by category, date, or merchant.

- Budget Creation: Tools to help you create and customize budgets based on your income and goals.

- Goal Setting: Features to help you set and track savings goals, like a down payment on a house or a dream vacation.

- Alerts and Notifications: Customizable alerts to notify you when you’re approaching your spending limits or when bills are due.

- Reports and Insights: Visual representations of your spending habits to help you identify patterns and areas for improvement.

Top Picks: Budgeting Apps That Excel

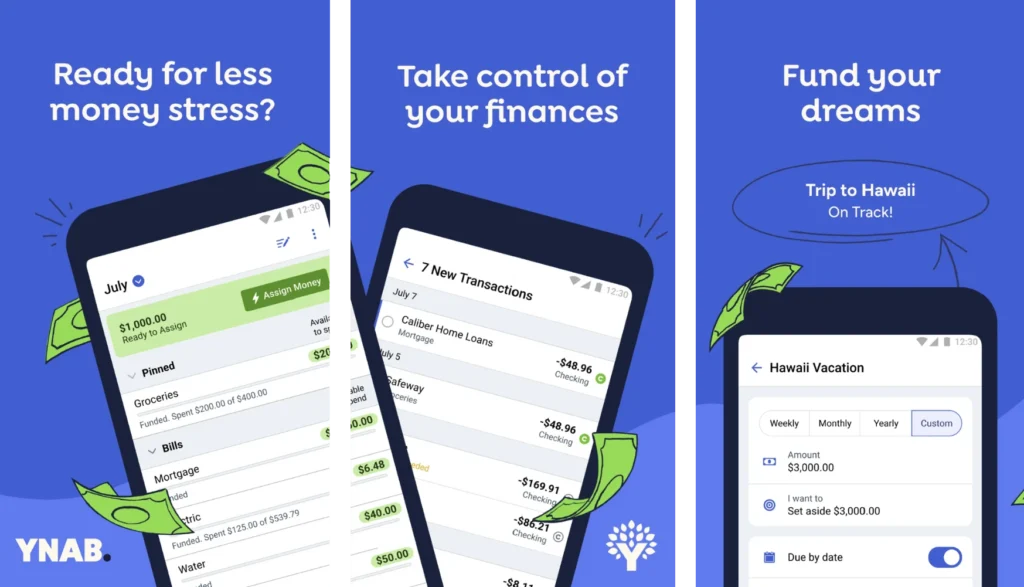

YNAB (You Need a Budget): Your Budget Coach in an App

YNAB isn’t just an app; it’s a budgeting philosophy. This powerful tool is based on the principles of zero-based budgeting, which means giving every dollar a job. Let’s break down what sets YNAB apart:

Key Features

- Goal-Oriented Budgeting: YNAB encourages you to set clear financial goals and allocate your income accordingly. It helps you prioritize spending, track your progress, and adjust your budget as needed.

- Real-Time Updates: Connect your bank accounts for automatic transaction imports, or manually add transactions to keep your budget up-to-date.

- Debt Snowball/Avalanche: YNAB offers tools to help you tackle debt strategically, whether you prefer the debt snowball (paying off the smallest debts first) or avalanche (paying off debts with the highest interest rates first) method.

- Age of Money: This unique feature tracks how long your money “ages” in your account, encouraging you to spend older dollars and build up savings, breaking the paycheck-to-paycheck cycle.

- Educational Resources: YNAB offers a wealth of educational resources, including workshops, videos, and articles, to help you master budgeting and achieve your financial goals.

Pros

- Effective Budgeting Philosophy: YNAB’s zero-based budgeting approach can be incredibly effective.

- Detailed Tracking: YNAB provides granular insights into your spending habits, helping you identify areas where you can cut back.

- Community Support: YNAB has a dedicated community forum where users can share tips, ask questions, and find support.

Cons

- Learning Curve: YNAB’s unique approach requires some initial learning and adjustment.

- Subscription-Based: YNAB is a paid app, but it offers a free trial to see if it’s a good fit for you.

- Not for Everyone: YNAB’s hands-on approach may not be ideal for those who prefer a more automated budgeting experience.

Price: YNAB offers a 34-day free trial, then it’s $14.99/month or $99/year.

Security: YNAB uses bank-level encryption to protect your data. It also offers two-factor authentication for added security.

PocketGuard: Your Financial Guardian Angel

PocketGuard aims to make budgeting less intimidating and more approachable. It is a simple, straightforward budgeting app that helps you stay on top of your spending.

Key Features

- Automatic Updates: Once connected to your accounts, PocketGuard will automatically pull in your transactions and categorize them, providing you with an up-to-date picture of your spending.

- In My Pocket: This feature calculates your “spendable” income after accounting for bills, recurring subscriptions, and savings goals. It gives you a real-time snapshot of how much money you have left to spend.

- Bill Negotiation: PocketGuard analyzes your recurring bills and identifies potential savings opportunities. It can even negotiate lower rates on your behalf for certain services.

- Categorized Spending: Your transactions are automatically categorized, allowing you to see where your money is going and identify areas where you can cut back.

- Savings Goals: Set and track your savings goals, whether it’s for a down payment on a house, a vacation, or an emergency fund.

- Personalized Insights: PocketGuard provides insights and recommendations based on your spending habits, helping you make better financial decisions.

Pros

- Simplicity: PocketGuard’s interface is clean, intuitive, and easy to understand, even for beginners.

- “In My Pocket” Feature: This unique feature provides a clear and actionable view of your available spending money.

- Bill Negotiation: The bill negotiation feature can potentially save you money on recurring expenses.

- Free Version: PocketGuard offers a free version with essential budgeting features.

Cons

- Limited Features in the Free Version: Some features, like personalized insights and debt payoff planning, are only available with the premium subscription.

- Limited investment tracking: PocketGuard focuses primarily on budgeting and spending, so it may not be the best choice if you are interested in investment tracking.

Price: PocketGuard has a free plan with basic features. The PocketGuard Plus plan is $12.99/month or $74.99/year and offers additional features like debt payoff planning and customized spending categories. It doesn’t offer a free trial of their PocketGuard Plus plan.

Security: PocketGuard uses 256-bit encryption, which is the same level of security many financial institutions use on their platforms to protect your data. It also allows you to set up a PIN or fingerprint for access to the app.

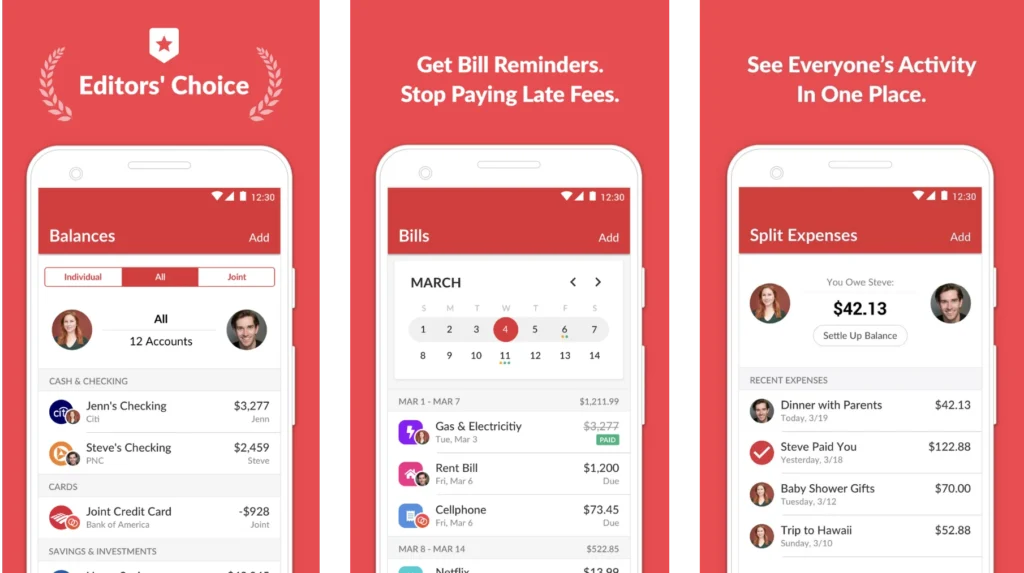

Honeydue: Budgeting Bliss for Couples

Honeydue is a free budgeting app designed specifically for couples, promoting transparency and collaboration in managing shared finances.

Key Features

- Shared Finances, Separate Accounts: Connect your individual bank accounts and credit cards to Honeydue, allowing you and your partner to see shared expenses and balances while maintaining privacy for individual spending.

- Bill Tracking and Reminders: Coordinate bill payments and set reminders to avoid late fees and disagreements.

- Customizable Categories: Create shared categories for joint expenses (like rent, groceries, or date nights) and track individual spending in separate categories.

- Comment and Emoji Reactions: Add comments and emojis to transactions for fun and easy communication about spending.

- Monthly Summaries: Get a clear overview of your combined income, spending, and net worth each month.

Pros

- Promotes Transparency: Honeydue helps couples communicate openly about their finances and avoid misunderstandings.

- Collaborative Budgeting: Couples can work together to set shared financial goals and track their progress.

- Fun and Engaging: The app’s social features make budgeting a more enjoyable experience for couples.

- Free: Honeydue is completely free to use, with no hidden fees or premium subscriptions.

Cons:

- Limited Features: Honeydue primarily focuses on shared finances and may not offer the same depth of features as some other budgeting apps.

- Not for Individuals: This app is designed specifically for couples and may not be suitable for solo budgeting.

- Privacy Concerns: While Honeydue prioritizes individual privacy, some couples may still feel uncomfortable sharing all their financial details.

Price: Free

Security: Honeydue uses 256-bit encryption, the same level of security used by most banks and financial institutions. Also, they do not store your bank login credentials, and they offer two-factor authentication for added protection.

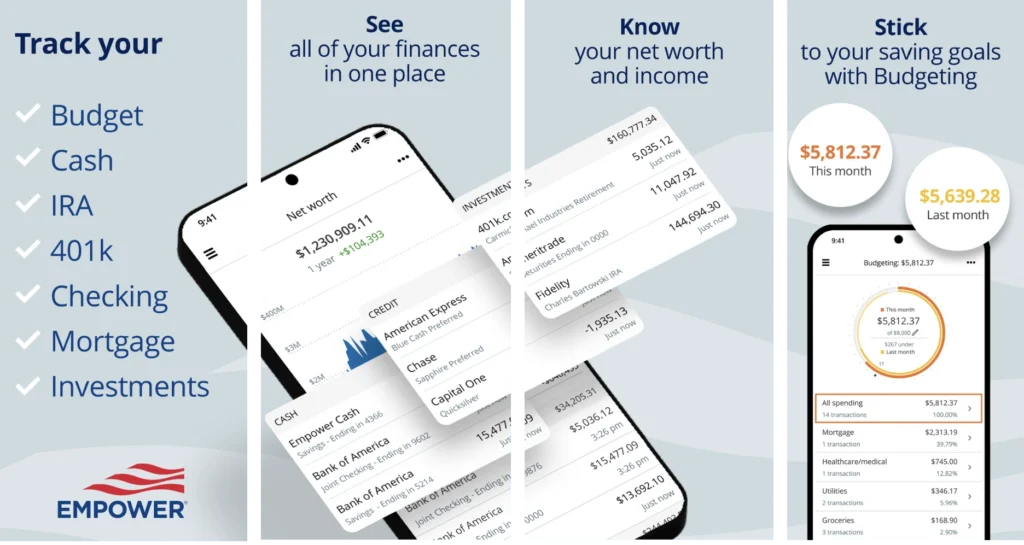

Personal Capital: Your Financial Dashboard for Investing and Retirement Planning

Personal Capital is a unique hybrid app that combines budgeting tools with investment management features. It’s a great option if you want to track your spending and investments in one place, especially if you’re focused on long-term financial goals like retirement.

Key Features

- Investment Tracking: Personal Capital connects to all your investment accounts, providing a comprehensive overview of your portfolio’s performance, asset allocation, and fees.

- Retirement Planner: The app includes a robust retirement planning tool that helps you project your future finances, set retirement goals, and track your progress.

- Fee Analyzer: Personal Capital analyzes the fees you’re paying on your investments, helping you identify potential savings opportunities.

- Financial Advisors: If you need more personalized guidance, Personal Capital offers access to financial advisors who can provide customized advice and investment management services.

- Cash Flow and Budgeting: Track your income and expenses, categorize your spending, and set budgets to stay on top of your financial goals.

Pros

- Comprehensive Financial Picture: Personal Capital provides a holistic view of your finances, including both spending and investments.

- Powerful Investment Tools: The app offers a wide range of investment features, including portfolio analysis, retirement planning, and fee tracking.

- Access to Financial Advisors: If you need professional guidance, you can easily connect with financial advisors through the app.

Cons

- Not for Beginners: Personal Capital’s focus on investing may be overwhelming for those who are new to budgeting or investing.

- Cost of Advisory Services: While the basic app is free, the investment advisory services come with a fee.

- Limited Budgeting Features: Compared to dedicated budgeting apps, Personal Capital’s budgeting features may be less robust.

Price: Personal Capital is free to use for basic tracking and budgeting features. The investment advisory services for users with $100,000+ in investable assets come with a fee, typically ranging from 0.49% to 0.89% of assets under management, depending on the size of your portfolio.

Security: Personal Capital uses multiple layers of security, including encryption, multi-factor authentication, and fraud monitoring, to protect your data.

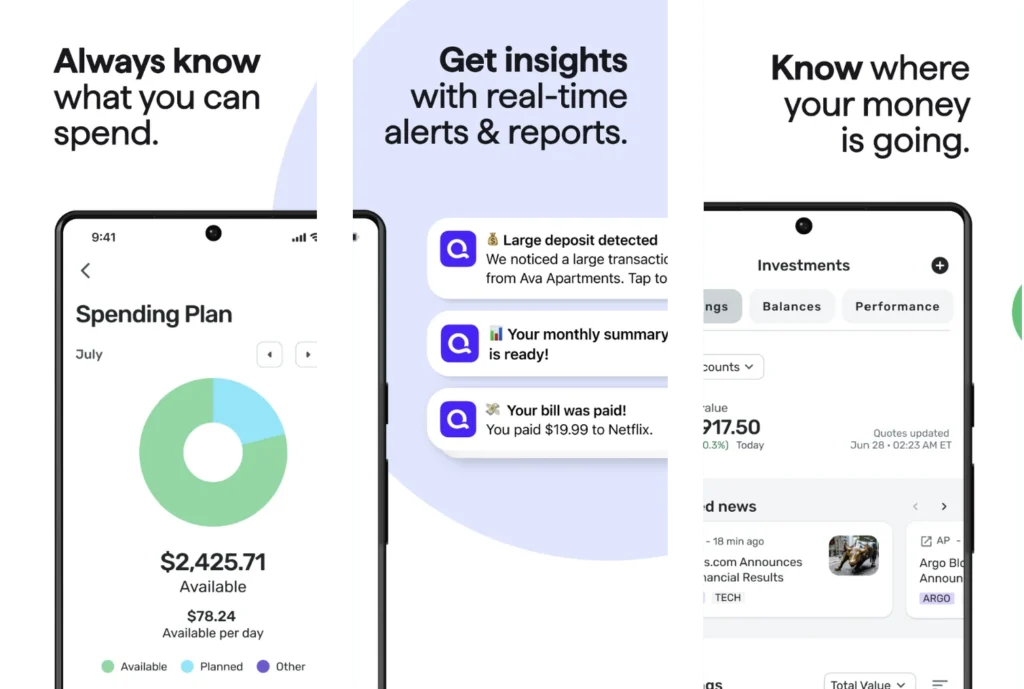

Simplifi by Quicken: Your Personalized Financial Assistant

Simplifi by Quicken aims to simplify your financial life by providing a personalized and proactive approach to budgeting and money management. It’s designed for those who want to gain a clear understanding of their finances and make smarter spending decisions.

Key Features

- Spending Plan: Simplifi helps you create a personalized spending plan based on your income, bills, and financial goals. It tracks your spending against this plan and provides real-time updates on your progress.

- Watchlist: This feature tracks your recurring subscriptions and bills, alerting you to upcoming payments and potential savings opportunities.

- Upcoming Spending: Simplifi predicts your upcoming expenses based on your spending patterns, helping you stay ahead of the curve and avoid surprises.

- Savings Goals: Set and track your savings goals, with visual progress bars and personalized insights to keep you motivated.

- Customizable Categories: Categorize your spending based on your preferences, making it easier to analyze your spending habits and identify areas for improvement.

- Investment Features: Real-time balance chart, performance graph, cryptocurrency tracking, a news feed, and investment transaction monitoring.

Pros

- Proactive Approach: Simplifi’s focus on upcoming expenses and personalized insights helps you plan ahead and avoid overspending.

- Easy to Use: The app’s interface is clean, intuitive, and designed to make budgeting feel less like a chore.

- Customizable: You can personalize the app to fit your specific needs and preferences.

- Strong Security: Simplifi uses bank-level encryption and two-factor authentication to protect your data.

Cons

- Subscription-Based: After a 30-day free trial, Simplifi requires a paid subscription.

- Not for Advanced Users: Those looking for in-depth investment tools or complex budgeting features may find Simplifi too basic.

Price: Simplifi costs $2.99/month and it offers a 30-day money-back guarantee.

Security: Simplifi uses bank-level encryption (256-bit) and two-factor authentication to protect your data.

Worth Checking Out

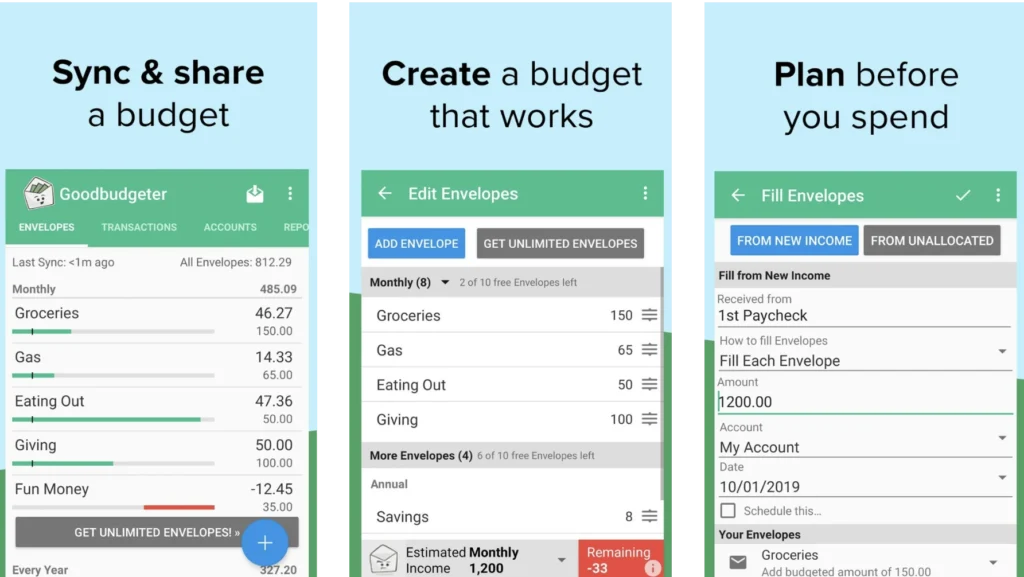

Goodbudget: Envelope Budgeting Made Digital

If you’re a fan of the envelope budgeting system, where you allocate cash to different spending categories, then Goodbudget is the app for you. It brings this classic budgeting method into the digital age, making it more convenient and accessible.

Key Features

- Virtual Envelopes: Create digital “envelopes” for different spending categories (like groceries, entertainment, or transportation) and allocate a specific amount of money to each one.

- Envelope Refills: When you run out of money in an envelope, you can refill it from another envelope or from your remaining income.

- Debt Snowball: Goodbudget includes a debt snowball feature to help you tackle your debts strategically.

- Syncing Across Devices: Your budget syncs across all your devices, so you can stay on top of your spending no matter where you are.

- Flexible Budgeting: Goodbudget allows you to adjust your budget as needed, making it easy to adapt to changing circumstances.

Pros

- Envelope Budgeting: Goodbudget is a great way to implement the popular envelope budgeting system without having to deal with physical cash.

- Simple and Intuitive: The app is easy to use and understand, even for beginners.

- Debt Snowball Feature: This feature can be helpful for those focused on paying off debt.

- Free Version: Goodbudget offers a free version with basic features.

Cons

- Limited Features in Free Version: The free version limits you to 10 regular and 10 more envelopes and two devices. To unlock unlimited envelopes and access on multiple devices, you’ll need to upgrade to the paid plan.

- Manual Entry: Unlike some apps that automatically track your spending, Goodbudget requires you to manually input your transactions.

- No Investment Tracking: Goodbudget focuses solely on budgeting and does not offer features like investment tracking or financial advice.

Price: Goodbudget offers a free plan with limited features. The Goodbudget Plus plan is $10/month or $80/year.

Security: Goodbudget uses bank-level encryption to protect your data. It also offers two-factor authentication for added security.

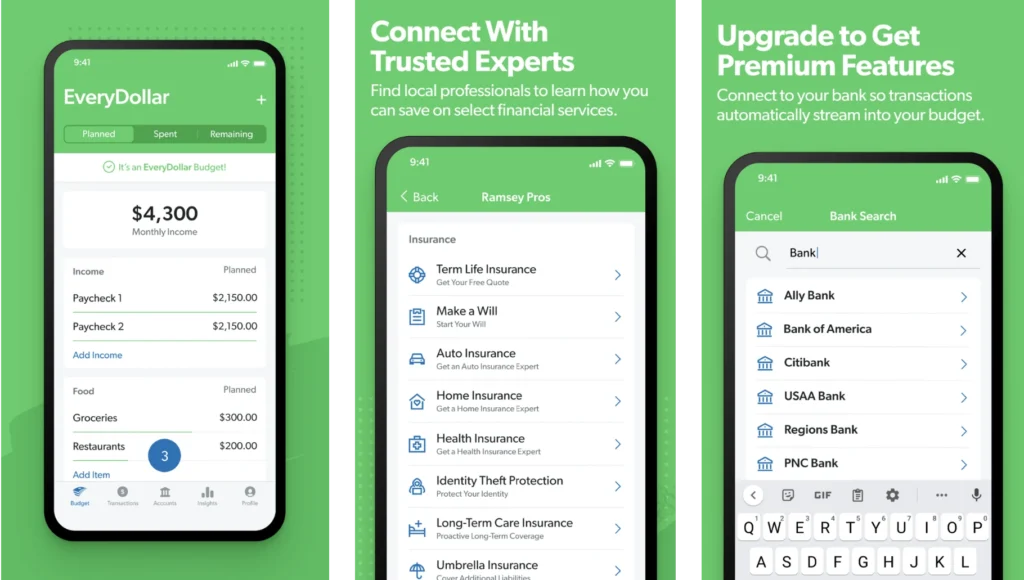

EveryDollar: Budgeting Made Simple with Dave Ramsey’s Approach

EveryDollar is a budgeting app created by Dave Ramsey, a popular personal finance personality known for his “baby steps” approach to getting out of debt and building wealth. The app is designed to be simple and easy to use, making it a good option for beginners or those who prefer a straightforward budgeting method.

Key Features

- Zero-Based Budgeting: EveryDollar follows Dave Ramsey’s zero-based budgeting philosophy, which means assigning every dollar of your income to a specific category until you reach zero.

- Baby Steps Integration: The app integrates with Ramsey’s seven “baby steps” financial plan, guiding you through the process of getting out of debt, saving for emergencies, and building wealth.

- Debt Tracker: EveryDollar helps you track your debt balances and payments, providing a visual representation of your progress toward becoming debt-free.

- Financial Peace University: The app integrates with Ramsey’s Financial Peace University course, offering additional educational resources and support.

Free vs. Premium Version: EveryDollar offers a free version with basic budgeting features. The premium version (EveryDollar Plus) unlocks additional features and benefits.

Free Version Features

- Manual Transaction Entry: Add and categorize your income and expenses manually.

- Monthly Budget Creation: Create a basic budget for the month.

- Basic Goal Tracking: Set and track savings goals.

Premium Version Features

- Bank Account Syncing: Connect your bank accounts for automatic transaction importing and categorization.

- Bill Reminders: Get reminders for upcoming bills.

- Paycheck Planning: Plan how to allocate your income across different budget categories.

- Custom Budget Reports: Create detailed reports to analyze your spending patterns.

- Financial Coaching: Access to financial coaching and expert Q&A sessions.

Pros

- Simplicity: EveryDollar’s interface is clean and easy to navigate, making it a good choice for beginners.

- Dave Ramsey’s Philosophy: If you’re a fan of Dave Ramsey’s teachings, you’ll appreciate the app’s alignment with his budgeting principles.

- Debt-Focused: The app is particularly helpful for those focused on paying off debt, with features like the debt snowball tracker.

Cons

- Limited Features in Free Version: The free version lacks some key features like bank syncing and bill reminders.

- Subscription Required for Premium Features: To access the full range of features, you’ll need to subscribe to the paid EveryDollar Plus plan.

Price: EveryDollar offers a free version with basic features. The EveryDollar Plus plan is $17.99/month or $79.99/year.

Security: EveryDollar uses bank-level encryption to protect your data. It also requires a strong password and offers additional security measures like two-factor authentication.

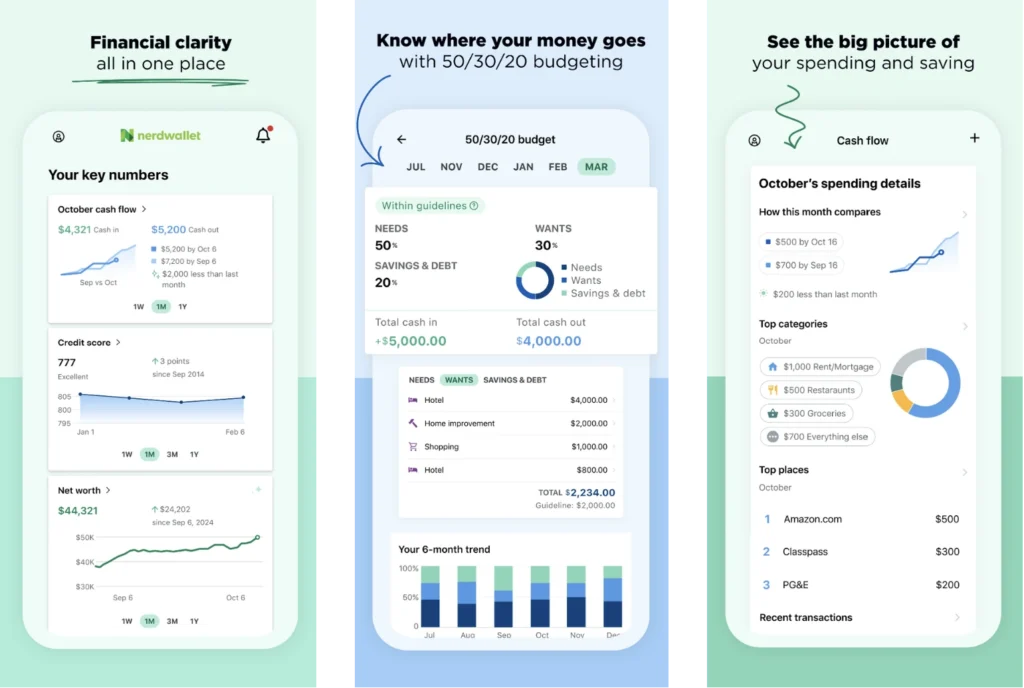

NerdWallet: Your Financial Nerd’s Best Friend

NerdWallet is more than just a budgeting app; it’s a comprehensive financial resource center. While it offers budgeting and expense-tracking tools, its true strength lies in its extensive library of financial information and educational resources.

Key Features

- Budgeting and Expense Tracking: Set budgets, track spending, and get insights into your financial habits.

- Financial News and Advice: Stay up-to-date on the latest financial news and trends, and access expert advice on topics like investing, credit cards, and loans.

- Comparison Tools: Easily compare different financial products, such as credit cards, mortgages, and insurance policies, to find the best deals.

- Credit Score Monitoring: Track your credit score and get personalized tips on how to improve it.

- Educational Resources: Access a wealth of educational articles, calculators, and tools to help you make informed financial decisions.

Pros

- Comprehensive Financial Resource: NerdWallet offers a wide range of financial tools and resources, making it a valuable tool for anyone looking to improve their financial literacy.

- Educational Focus: The app prioritizes education, empowering users to make informed financial decisions.

- Free to Use: NerdWallet is completely free to use, with no hidden fees or premium subscriptions.

Cons

- Not the Most Intuitive Budgeting App: While NerdWallet offers budgeting tools, its interface may not be as user-friendly as some other dedicated budgeting apps.

- Overwhelming Amount of Information: The sheer volume of information and resources available on NerdWallet can be overwhelming for some users.

Price: Free

Security: NerdWallet employs robust security measures to protect user data. They use industry-standard encryption to safeguard personal and financial information, implement strict access controls, and regularly monitor for security threats. They also offer two-factor authentication.

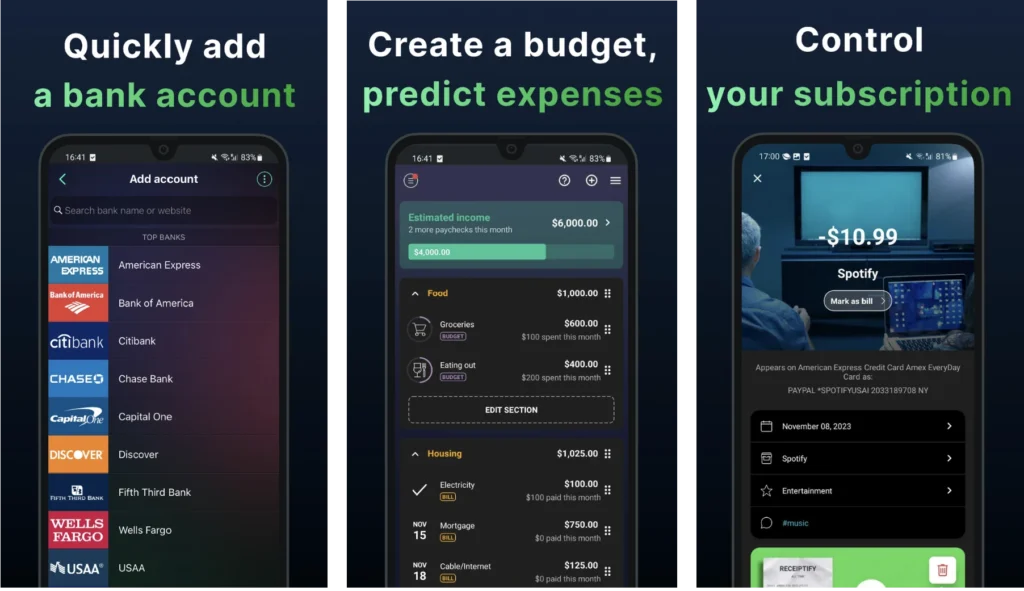

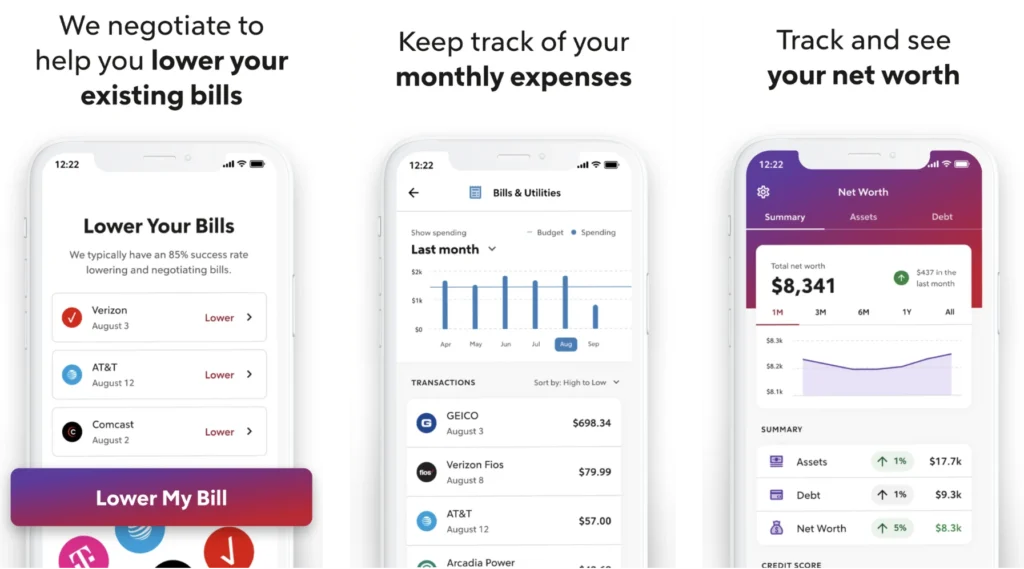

Rocket Money (Formerly Truebill): Your Subscription Buster and Bill Negotiator

Rocket Money (formerly Truebill) is a unique app that focuses on helping you save money by managing your subscriptions, lowering your bills, and tracking your spending.

Key Features

- Subscription Management: Rocket Money automatically identifies your recurring subscriptions and helps you cancel unwanted ones with just a few taps.

- Bill Negotiation: The app can negotiate lower rates on your bills, such as your internet, cable, or phone bill.

- Spending Insights: Track your spending by category, set budgets, and get personalized insights to help you save money.

- Smart Savings: Rocket Money can automatically set aside small amounts of money from your checking account to help you reach your savings goals faster.

- Credit Monitoring: Keep an eye on your credit score and get alerts for potential fraud or errors.

Pros

- Subscription Cancellation: Rocket Money makes it incredibly easy to cancel unwanted subscriptions, potentially saving you a significant amount of money.

- Bill Negotiation: The bill negotiation feature can be a game-changer for lowering your monthly expenses.

- Automatic Savings: The smart savings feature can help you build your savings effortlessly.

Cons

- Subscription Required: Rocket Money requires a subscription to access all features.

- Limited Budgeting Features: While Rocket Money offers basic budgeting tools, its primary focus is on subscription management and bill negotiation.

Price: Rocket Money offers a free version with basic features and members can choose monthly prices between $6-$12 per month for additional features.

Security: Rocket Money uses bank-level encryption to protect your data. They also have a strict privacy policy and do not sell user data to third parties.

Take Control of Your Finances, One Tap at a Time

So, there you have it! Explore the apps we’ve discussed, take advantage of free trials, and find the perfect fit for your lifestyle and goals. Don’t let another day go by feeling stressed or overwhelmed about your finances. Remember, the best budgeting app is the one you’ll actually use consistently.

FAQs

Are budgeting apps safe?

Most reputable budgeting apps use bank-level security measures, like 256-bit encryption, to protect your data. Look for apps that offer two-factor authentication and have clear privacy policies.

What happens to my data if I stop using a budgeting app?

Check the app’s privacy policy to see how they handle your data after you stop using their services. Reputable apps will usually allow you to delete your account and data if you wish.

Can budgeting apps help me improve my credit score?

Some budgeting apps offer credit score monitoring and provide tips on how to improve your score. However, the act of budgeting itself doesn’t directly impact your credit score.