Photo credit: Cash App

What exactly is a payment app, and why should you care? Payment apps let you store your payment information securely on your phone, making transactions as easy as a tap or a glance. If you’ve ever used Apple Pay or Google Pay, you’ve already experienced the convenience of digital wallets. If you want to take a closer look at the world of digital wallets, we’ve got you covered with a detailed article on the topic.

But today, we’re zooming in on the best payment apps specifically. Let’s take a look at the top contenders so you can choose the perfect sidekick for your financial adventures.

What Makes a Payment App the “Best”?

Photo credit: Apple

Before we unveil our top picks, let’s talk about what actually makes a payment app stand out from the crowd. After all, “best” is subjective, and what works for one person might not be ideal for another. Here are a few key factors to consider when choosing your financial sidekick:

- Security Features: This is non-negotiable. Your payment app should offer top-notch security features like encryption, two-factor authentication, and fraud protection. We’re talking Fort Knox-level security for your money, folks.

- Ease of Use: A great payment app should be intuitive and user-friendly, even for those who aren’t tech-savvy. No one enjoys struggling with a complex interface when they’re just trying to buy a latte.

- Fees and Limits: Pay attention to transaction fees, withdrawal limits, and any other potential costs. Some apps are free for basic use, while others might charge a small percentage for certain transactions.

- Accepted Payment Methods: Does the app work with your bank accounts, credit cards, and preferred payment methods? Make sure it aligns with your financial habits.

- Extra Features: Some apps go above and beyond with features like peer-to-peer payments (think Venmo for splitting the dinner bill), rewards programs, or even investment options. Consider which bells and whistles would make your life easier or more rewarding.

Now that you know what to look for, let’s explore some of the top payment apps on the market.

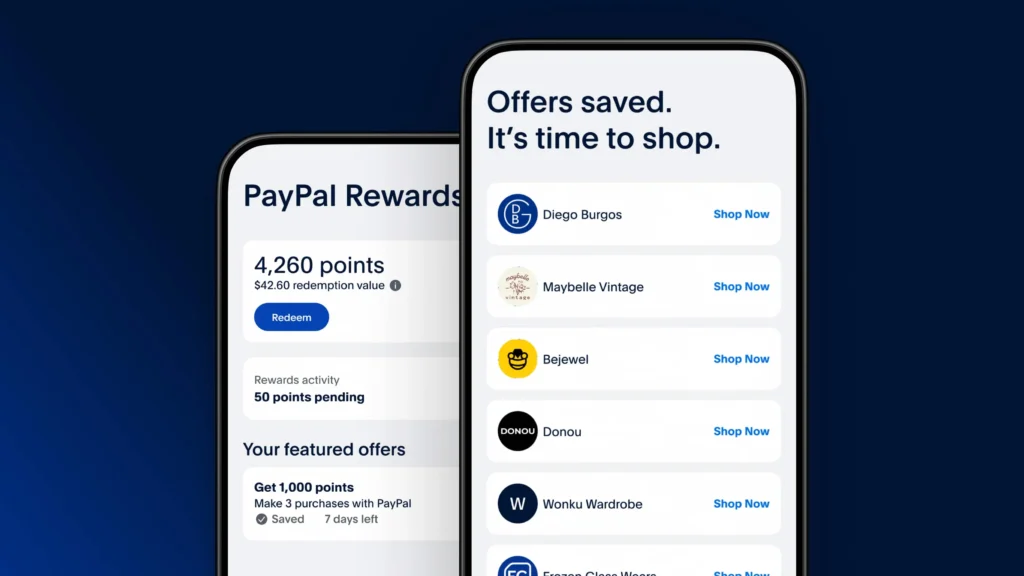

PayPal: The Rolling Stones of Online Payments

Photo credit: PayPal

If payment apps were a rock band, PayPal would be the Rolling Stones – a seasoned veteran with a massive fan base and a track record that speaks for itself. Launched in 1998 (ancient history in tech years!), PayPal has become synonymous with online transactions.

Pros

- Widely accepted: PayPal’s widespread acceptance makes it a convenient choice for online and in-store shopping. You’ll spot the familiar PayPal logo on most of your favorite websites.

- Trusted reputation: With over two decades of experience, security is a top priority for PayPal, with features like buyer and seller protection, fraud monitoring, and dispute resolution. Your hard-earned cash is in good hands.

- Buyer/seller protection: PayPal offers protection for both buyers and sellers. If you don’t receive an item you purchased or encounter a transaction hiccup, you might be eligible for reimbursement.

- Cross-Platform Compatibility: Unlike some picky apps, PayPal isn’t restricted to a specific brand of device. You can use it on iOS, Android, or even your trusty old computer.

- More Than Just Payments: Beyond payments, PayPal offers a range of features, including sending/receiving money, splitting bills, donating to charity, and investing in cryptocurrency.

- One Touch™: This convenient feature lets you stay logged into your PayPal account on your favorite devices, so you can check out with just a tap without having to re-enter your password every time.

- PayPal Credit: PayPal offers a line of credit that you can use to make purchases or get cash back at checkout.

Cons

- Fees: While many transactions are free, PayPal charges fees for certain transactions, like international money transfers or using PayPal Credit.

- Customer Service: PayPal’s customer service can be slow or unresponsive at times.

Who’s PayPal Perfect For?

- Online shoppers: PayPal’s buyer protection and wide acceptance make it a great choice for online purchases.

- Frequent travelers: PayPal supports multiple currencies, making it convenient for international transactions.

- Business owners: PayPal offers a suite of tools for businesses, from invoicing to accepting payments.

Venmo: The Social Butterfly of Payments

Photo credit: Venmo

If PayPal is the rock star grandpa of payment apps, Venmo is more like Taylor Swift – young, trendy, and with a massive social media following. With its social feed and playful emojis, Venmo isn’t just about payments; it’s about connecting with friends and making transactions fun.

Launched in 2009, Venmo quickly became a favorite for millennials and Gen Z-ers who love its casual vibe and seamless way to settle up with friends. It’s like a digital wallet with a side of social networking.

Pros

- User-Friendly: Venmo’s interface is sleek, intuitive, and designed for the smartphone generation.

- Social Feed: Every transaction comes with an optional comment and emoji, turning your payments into a mini-story. You can see what your friends are up to, react to their payments, and even leave a witty remark or two.

- Free for Basic Transactions: Sending money from your Venmo balance or linked bank account is usually free.

- Splitting Bills: The “split bill” feature is a lifesaver for group outings, making it easy to divvy up the costs of dinner, drinks, or that weekend getaway.

- Sending a Gift: Forgot your bestie’s birthday? Send them a Venmo payment with a personalized message and a cute emoji. It’s the thought that counts, right?

- Paying Your Roommate: No more awkward conversations about who owes who and how much. Venmo lets you settle up quickly and painlessly.

- Request Money: Need to remind your forgetful friend to pay you back? Venmo’s got your back with a gentle (or not-so-gentle, depending on your style) reminder feature.

Cons

- Not as Widely Accepted: Venmo isn’t as universally accepted as PayPal, so you might not be able to use it everywhere.

- Privacy Concerns: The social feed can be a double-edged sword. If you prefer to keep your financial transactions private, Venmo might not be the best fit.

- Potential for Scams: Be cautious when using Venmo with people you don’t know well, as there have been reports of scams and fraud.

- Transaction Limits: Without verifying your identity, you might be restricted in how much money you can send or receive using the app.

Who’s Venmo Perfect For?

- Friends and Roommates: If you’re constantly splitting bills with friends or roommates, Venmo makes it a breeze.

- Social Butterflies: If you love the social aspect of sharing your financial activities, Venmo’s feed will be your jam.

- Younger Users: Venmo’s hip and trendy vibe resonates with millennials and Gen Z.

Venmo might not be the most serious payment app out there, but if you’re looking for a fun, social way to manage money, it’s hard to beat. Just remember to keep an eye on your privacy settings, as your transactions can be visible to others in your network.

Zelle: The Speedy Gonzales of Bank Transfers

Photo credit: Zelle

While PayPal and Venmo are busy battling it out for online supremacy, Zelle has quietly carved out its own niche in the world of payment apps. This bank-backed app is all about speed and simplicity, making it the perfect choice for those who need to send or receive money quickly and directly from their bank accounts.

Think of Zelle as the express lane for your money. It bypasses the middleman and connects directly to your bank, allowing for near-instantaneous transfers.

Pros

- Lightning-Fast Transfers: Zelle is known for its blazing-fast speed. In most cases, money sent through Zelle arrives in the recipient’s bank account within minutes, sometimes even seconds.

- No Fees (Usually): Unlike some other apps that charge fees for certain transactions, Zelle is generally free to use. However, check with your bank to be sure, as they might have their own policies.

- Bank-Backed Security: Since Zelle is integrated with many major banks, it benefits from the security measures and fraud protection already in place at your financial institution.

Cons

- Limited Functionality: Zelle is primarily for sending and receiving money; it doesn’t offer the same range of features as PayPal or Venmo.

- No Buyer/Seller Protection: Unlike PayPal, Zelle doesn’t offer protection for purchases, so use it with caution when dealing with people you don’t know well.

- Not Available Everywhere: Zelle is only available in the U.S. and through participating banks.

Who’s Zelle Perfect For?

- Quick Transactions: If speed is your top priority, Zelle is the way to go.

- Bank Lovers: If you prefer to keep your financial transactions within your trusted bank’s ecosystem, Zelle is a natural fit.

Cash App: The Many-Sided Financial Tool

Photo credit: Cash App

If PayPal is the seasoned veteran and Venmo is the social butterfly, then Cash App is the ambitious overachiever, juggling multiple talents with impressive finesse. Launched in 2013 by Square (the company behind those sleek white card readers you see at coffee shops), Cash App has grown from a simple peer-to-peer payment app into a full-fledged financial platform.

Think of Cash App as your all-in-one financial toolkit. It’s not just about sending and receiving money; it’s about investing, buying Bitcoin, and even filing your taxes.

Pros

- Send and Receive Money: Like its peers, Cash App lets you easily send and receive money from friends, family, and even businesses.

- Cash Card: Get a customizable debit card (available in sleek black or vibrant colors) linked to your Cash App balance, allowing you to spend your money anywhere Visa is accepted.

- Investing: Dip your toes into the stock market by buying fractional shares of your favorite companies, all within the Cash App.

- Bitcoin Boost: Earn Bitcoin rewards on your Cash Card purchases at select retailers.

- Taxes: Cash App Taxes (formerly Credit Karma Tax) offers a free and user-friendly way to file your federal and state taxes.

- User-Friendly: The interface is clean, modern, and easy to navigate.

Cons

- Fees: While basic features are free, there are fees for certain transactions, like instant deposits or using a credit card.

- Customer Service: Some user reviews suggest that customer service response times could be improved.

Who’s Cash App Perfect For?

- Investors: If you’re interested in dabbling in stocks or Bitcoin, Cash App’s investment features are a convenient starting point.

- Budgeters: The app’s spending insights and budgeting tools can keep tabs on your money so you can stay on top of your goals.

If you’re looking for a payment app that goes beyond the basics and offers a wide range of financial services in one convenient place, Cash App might be the perfect fit for you.

Using Payment Apps Safely: Don’t Get Scammed!

While payment apps are incredibly convenient, it’s important to use them wisely and protect yourself from potential scams or fraud. Here are a few tips to keep your money safe:

- Strong Passwords: Choose a strong password (or better yet, use biometric authentication like fingerprint or facial recognition) to lock down your payment app. Treat it like your online bank account and enable two-factor authentication if available. This provides an additional safeguard for your account.

- Beware of Phishing Scams: Be cautious of emails, texts, or calls asking for your login information or personal details. Legitimate payment apps will never ask for this information via these channels.

- Exercise caution with strangers: Avoid sending money to strangers or for goods and services that seem too good to be true. If a deal sounds fishy, it probably is.

- Update Regularly: Make sure you have the latest version of your payment app installed. Regular updates typically include fixes for security flaws, ensuring your financial information remains protected.

- Check Your Statements Regularly: Review your payment app transactions and bank statements regularly to spot any unauthorized activity. If you see something suspicious, report it immediately to your bank or the payment app provider.

By following these simple tips, you can enjoy the convenience and benefits of payment apps while minimizing the risk of falling victim to scams or fraud.

The Best Payment Apps: Finding Your Perfect Match

As we’ve seen, the world of payment apps is as diverse as your financial needs. There’s no one-size-fits-all answer to the question of which app is “best.” The ideal choice for you depends on your lifestyle, spending habits, and personal preferences.

Are you a social butterfly who loves splitting bills with friends? Venmo might be your soulmate. Do you crave speed and simplicity for everyday transactions? Zelle could be your perfect match. Are you an online shopping fan or a frequent international traveler? PayPal might be your trusty companion. Or perhaps you’re a tech-savvy investor looking to explore new financial frontiers? Cash App could be your adventurous sidekick.

No matter which app you choose, remember to use it wisely, stay vigilant against scams, and enjoy the convenience and freedom that these powerful tools offer.

So, go forth and explore the world of payment apps! Embrace the future of finance and discover the perfect payment pal to simplify your life and make your financial journey a little more enjoyable.

FAQs

Are payment apps safe to use?

When used responsibly, payment apps are generally safe. Look for apps with strong security features like encryption, two-factor authentication, and fraud protection. Be sure to create strong passwords and avoid sharing your personal information with anyone.

Can I use payment apps internationally?

Some payment apps, like PayPal, are widely accepted internationally and support multiple currencies. Others, like Venmo or Zelle, might have limited international functionality. Check the app’s terms and conditions to see if it’s suitable for international transactions.

Can I use a payment app if I don’t have a bank account?

Yes, some payment apps, like Cash App, allow you to create an account without linking a bank account. However, you might have limited functionality and lower transaction limits until you verify your identity and link a bank account.