Photo credit: Apple (TechNovus Lens)

If you haven’t embraced the world of digital wallets yet, you’re missing out on a serious upgrade to your everyday life. Imagine paying for groceries, transit, or even your morning latte with just a tap of your phone (or your wrist). That’s the convenience and security that the best digital wallets offer, transforming the way we pay. Apple, Google, and Samsung have designed their wallets to work seamlessly within their own ecosystems. That means your choice of phone often dictates your digital wallet destiny. Understanding the unique strengths of each wallet can help you make the most of the one that’s right for you, and who knows, it might even sway your next phone upgrade decision.

So, what exactly is a digital wallet?

Digital wallets are like virtual versions of your physical wallet, but even better. They not only store your credit and debit cards, loyalty cards, boarding passes, and even digital keys, but also allow you to pay for things simply by tapping your phone or smartwatch at a compatible terminal.

Now, let’s break it down and see what each of these tech giants has to offer. Don’t worry, we’ll keep it simple and fun—because who said learning about tech has to be boring?

Digital Wallets vs. Payment Apps: What’s the Difference?

Before we explore specific wallets, let’s clear up some confusion. The terms “digital wallet” and “payment app” are often used interchangeably, but they’re not quite the same thing.

Digital wallets: Think of these as a virtual version of your physical wallet. They store your credit and debit card information, allowing you to make contactless payments in stores or online. But digital wallets can do more than just payments. They can also store loyalty cards, gift cards, boarding passes, event tickets, and even digital keys. Essentially, a digital wallet aims to replace the contents of your physical wallet and provide a convenient way to carry all your essentials on your phone.

Payment Apps: These apps focus primarily on facilitating money transfers between individuals. While some payment apps offer additional features like the ability to make purchases or invest in stocks, their main function is to send and receive money quickly and easily. Examples include Venmo, Cash App, and Zelle.

While some apps like PayPal and Google Wallet blur the lines between digital wallets and payment apps, understanding this basic distinction can help you choose the right tool for your needs. If you’re looking for a comprehensive way to replace your physical wallet and manage various aspects of your life, a digital wallet might be the better choice. However, if you mainly need to send and receive money, a payment app might be a more suitable option. If you want to take a closer look at the world of payment apps, we’ve got you covered with a detailed article on the topic.

Apple Pay: The iWallet

Photo credit: Apple

If you’re rocking an iPhone, Apple Watch, iPad, or even a Mac, then Apple Pay is probably already on your radar. It’s the default digital wallet for Apple devices, and it’s known for its seamless integration with the Apple ecosystem.

So, what makes Apple Pay so appealing?

- Seamless Integration: Apple Pay works beautifully with your iPhone, Apple Watch, iPad, and even your Mac. Once you’ve added your cards, you can use them across all your devices with just a touch or a glance.

- Holds More Than Just Cards: Apple Wallet can also store your boarding passes, event tickets, transit cards, and even digital keys, keeping everything you need in one place.

- Privacy and Security: Apple is known for its tight security, and Apple Pay is no exception. When you add a card to Apple Pay, your actual card details aren’t stored on your phone or Apple’s servers. Instead, a unique Device Account Number is assigned to each transaction. This number, along with a dynamic security code, is what gets transmitted during a purchase, so your card information is never exposed.

- Express Transit: In supported cities, you can use Express Transit to tap and pay for public transport without even needing to wake your device or authenticate.

- Apple Cash: This is a digital card in your Wallet app. You can add money to it from your bank account or debit card, use it to send or receive money with Apple users, and make purchases wherever Apple Pay is accepted, just like you would with a physical debit card.

- Apple Card: This is a credit card issued by Goldman Sachs and designed to be used with Apple Pay. It offers features like daily cashback rewards, spending tracking tools, and a physical titanium card for places that don’t accept contactless payments.

- Global Reach: Apple Pay is accepted in 80 countries, making it a widely accessible option for international travelers. However, the availability of specific features like Apple Cash or transit card integration may vary depending on your location.

But Apple Pay isn’t without its quirks. It is exclusive to Apple, so if you’re not an Apple user, you’re out of luck. Apple Pay is strictly for the Apple faithful. So, if you’re already knee-deep in the Apple world, Apple Pay is a no-brainer. It’s convenient, secure, and integrates seamlessly with your other Apple devices.

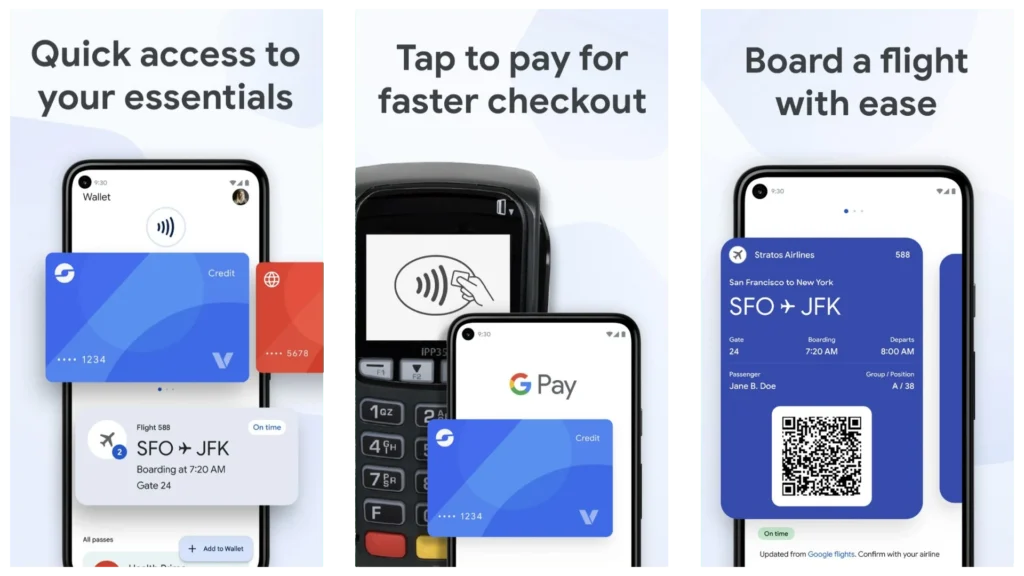

Google Wallet: The Android Choice

If you’re part of the Android crowd, Google Wallet is the digital wallet that’s probably already hanging out on your phone. And even if you don’t have it yet, it’s easy to download and get started.

Key Features

- Android Integration: Being Google’s own creation, Google Wallet seamlessly integrates with your Android phone, making it easy to add cards, track your spending, and manage your loyalty programs. It even works with Wear OS smartwatches for convenient wrist payments. You can link it directly to your Google account, making setup a breeze and syncing your payment information across all your devices.

- Open Ecosystem: Unlike Apple Pay, Google Wallet isn’t tied to a specific brand of phone. As long as you have an Android device with NFC (Near Field Communication) capabilities, you’re good to go.

- Security and Convenience: Google Wallet uses industry-standard security measures to protect your financial information. It also offers features like card lock and transaction history for added peace of mind.

- Beyond Payments: Google Wallet can store boarding passes, event tickets, transit cards, and even digital car keys (on compatible vehicles). It’s your all-in-one digital organizer for life on the go.

- Sending and Receiving Money: While peer-to-peer payments through the Google Pay app are being phased out in the U.S., you can still use Google Wallet to send money directly from your debit card or bank account or to request money from others.

- Tap to Pay on Fitbit: With select Fitbit smartwatches and trackers, you can use Google Wallet to make purchases on the go, even without your phone.

- Global Reach: Google Wallet is available in over 85 countries for contactless payments, making it a great option for travelers or those living abroad. However, some features, like peer-to-peer payments, might only be available in specific regions (currently the US, India, and Singapore).

But even Google Wallet isn’t perfect. Compared to Apple Pay’s seamless integration, Google Wallet’s user interface can feel a bit clunky at times. It can take a bit of getting used to.

Samsung Pay: The Underdog with a Secret Weapon

Photo credit: Samsung

Samsung might not be the first name that comes to mind when you think of digital wallets, but don’t underestimate it. Samsung Pay has some unique features that might just make it your go-to payment method.

Here’s what makes Samsung Pay stand out in the field of digital wallets:

- MST Technology: This is where Samsung Pay truly shines. MST (Magnetic Secure Transmission) technology allows your phone to mimic the magnetic strip of a traditional credit card. This means you can use Samsung Pay at virtually any payment terminal, even older ones that don’t support contactless payments. It’s a game-changer for those who frequent mom-and-pop shops or travel to places where contactless isn’t the norm.

- Samsung Rewards: Samsung sweetens the deal with a rewards program that earns you points for every purchase. You can redeem these points for gift cards, Samsung products, and even cash back.

- Samsung Wallet Integration: Samsung Pay is part of the broader Samsung Wallet app, which also lets you store digital keys, boarding passes, event tickets, and more. It’s a one-stop shop for all your digital essentials.

- Biometric Authentication: Samsung Pay prioritizes security by offering fingerprint, iris scanning, or PIN authentication for each transaction.

- Availability: While not as widely available as Apple Pay or Google Wallet, Samsung Pay is still accepted in around 30 countries, making it a viable option for users in many regions.

But Samsung Pay isn’t without its drawbacks:

- Exclusivity: Like Apple Pay, Samsung Pay is exclusive to Samsung devices. If you’re not a Samsung user, this wallet isn’t an option for you.

- Less Streamlined Interface: Compared to Apple Pay and Google Wallet, Samsung Pay’s interface can feel a bit clunky and less intuitive for some users.

If you own a Samsung device and frequent places that don’t always have contactless payment options, Samsung Pay might be your best bet. Its MST technology gives it an edge in terms of acceptance, and the rewards program is a nice bonus.

Other Notable Digital Wallets

Photo credit: Fitbit

While Apple Pay, Google Wallet, and Samsung Pay are the major players in the digital wallet space, several other options cater to specific needs or preferences.

- Fitbit Pay/Garmin Pay: If you’re a fitness enthusiast who prefers to leave your phone behind during workouts, Fitbit Pay and Garmin Pay allow you to make contactless payments directly from your smartwatch.

- Click to Pay: Backed by major card networks, Click to Pay is an online checkout solution designed to simplify and secure online transactions. You’ll often see this option alongside other payment methods at checkout.

- Store-Specific Wallets: Many retailers like Starbucks, Walmart, and Target have their own digital wallets within their apps. These can be convenient for loyal customers, offering rewards and exclusive benefits.

While these alternative options might not offer the same breadth of features as the major players, they can be valuable for specific use cases or preferences. Exploring these alternative digital wallets could be worth your while.

Remember, the world of digital payments is constantly evolving, so keep an eye out for new features and updates from your chosen wallet. And most importantly, have fun exploring the convenience and security that digital wallets have to offer!

FAQs

Are digital wallets safe?

Yes, digital wallets are generally considered safer than traditional wallets. They use tokenization, which replaces your actual card information with a unique code, and most require biometric authentication (fingerprint, face ID) or a PIN for added security.

What happens if I lose my phone with my digital wallet?

If you lose your phone, you can remotely lock or erase it to prevent unauthorized access to your digital wallet. You can also contact your bank or card issuer to suspend your cards linked to the wallet.

What is the difference between digital wallets and payment apps?

While the terms are often used interchangeably, there is a subtle distinction:

- Digital wallets: They are like virtual versions of your physical wallet, but even better. They not only store your credit and debit cards, loyalty cards, boarding passes, and even digital keys but also allow you to pay for things simply by tapping your phone or smartwatch at a compatible terminal.

- Payment apps: Primarily focus on facilitating money transfers between individuals. While some offer additional features, their main function is to send and receive money quickly and easily.